17-18 JUNE 2025 / NEW YORK MARRIOTT MARQUIS / NEW YORK, N.Y., USA

17-18 JUNE 2025 / NEW YORK MARRIOTT MARQUIS / NEW YORK, N.Y., USA

PAST

EVENTS

17–18 JUNE 2024 | NEW YORK CITY, NEW YORK, USA

Global Steel Dynamics Forum: Innovation, Illumination and Inspiration

The global steel industry’s commitment to adaptation and innovation is as durable as steel itself. It is, as Linde plc chief executive officer Sanjiv Lamba recently noted, a hallmark. “You constantly innovate. Efficiency is right on top of your agenda. All great steel companies demonstrate that commitment,” he said from the floor at the 2024 Global Steel Dynamics Forum, which was held 17–18 June 2024 in New York City.

The Forum is meant to offer a high-level, wide-ranging look at the state of the global steel industry and a window into the thinking of those who are leading it. Granted, Lamba was speaking to a room full of customers, but his observation is nevertheless reflective of an industry sprinting toward the future, given the billions of dollars invested in new process technologies, the new sustainability practices that are being introduced and responsive adaptation being made to shifting market demands.

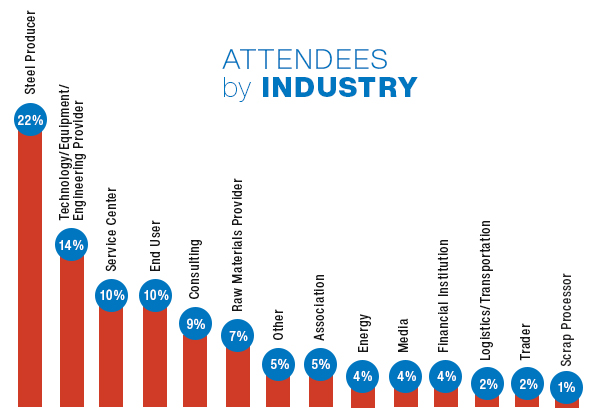

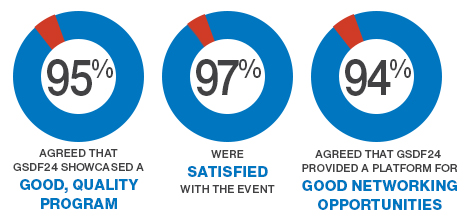

EVENT STATISTICS

Association for Iron & Steel Technology

Association for Iron & Steel Technology